FIRE Portfolio: Pick One of Those and Retire Early

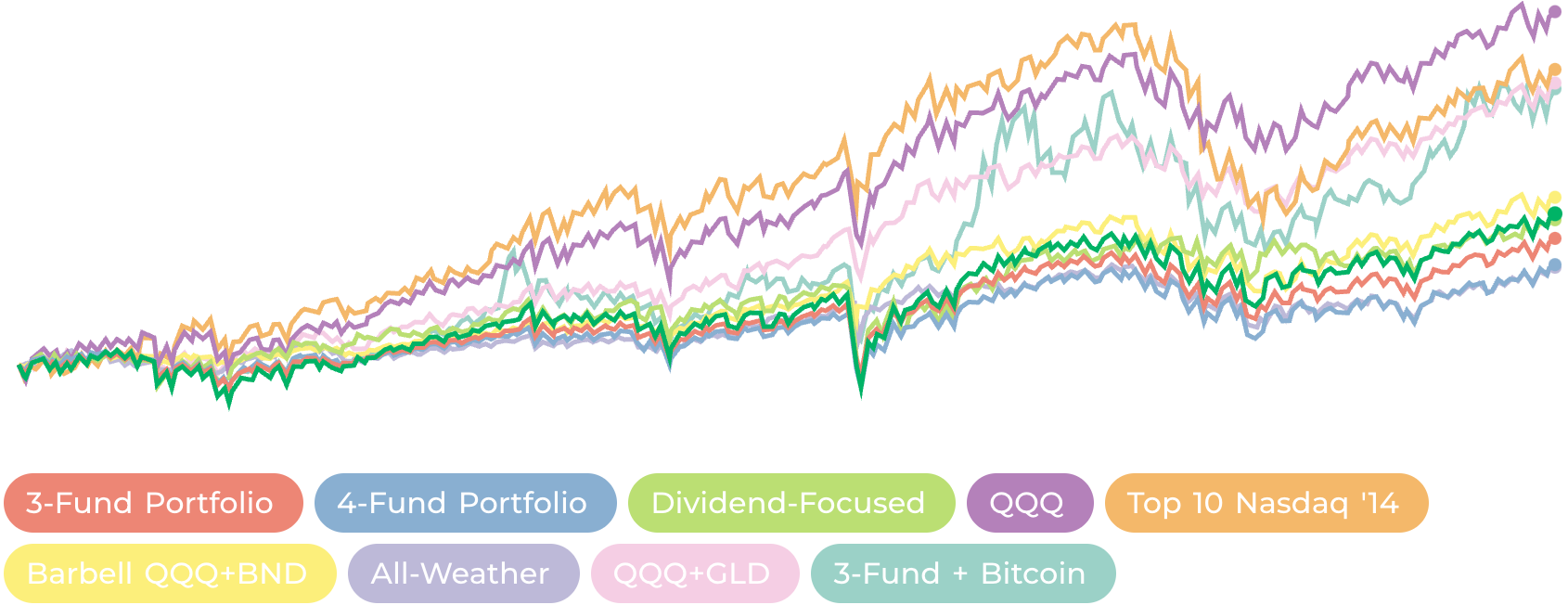

11 examples of FIRE asset allocation with 10 year backtest

The perfect FIRE portfolio depends on your age, risk tolerance, the types of risks you take into account, and even what assets you have access to. Don’t worry. You’re in the right place. I’ll explore 12 different portfolios, from classic recommendations to alternative approaches, covering the needs of most investors and give you the knowledge to adjust them to your preferences.

Table of Contents

What is FIRE?

FIRE (Financial Independence, Retire Early) is a movement where people save and invest aggressively to build enough wealth to retire early and live off their investments, achieving freedom from traditional work.

25X retirement rule

To retire early, you need enough capital. Common wisdom is that for a well-designed portfolio, the safe withdrawal rate is 4% a year. That means a portfolio 25 times larger than your annual expenses should never run out of money. Some people say it’s too pessimistic, and 5% is still fine. Great, but collecting even 20 times your annual expenses is quite a task.

The FIRE approach has two parts:

- Limit your expenses so your annual spending is not bigger than necessary.

- Put all saved money to work in the market.

So, let’s learn how to put your portfolio “on FIRE.”

Check our new FIRE Calculator ->

What is a FIRE portfolio?

How is the FIRE investment portfolio different from other portfolio recommendations? The key is in the letter “E” — the goal to retire “early” is what makes FIRE a more aggressive strategy than what many people choose.

To achieve the ambitious goal of early retirement, you have to accept higher risk. Simply buying government bonds and mutual funds at your bank will not get you there. Don’t worry, we don’t consider the risk of losing your life savings, but only some short-term price volatility to endure. What you need, though, is high exposure to diversified, low-cost, growth assets.

Grow

Stocks are the default growth asset to consider. For many reasons, we should also notice Bitcoin, gold, and real estate, but the basic FIRE portfolio relies on stocks. I will exclude real estate completely because, despite offering sufficient long-term returns, with a typical middle-class income, it will not necessarily enable you to retire “early,” and managing it is, in my view, a job anyway. You want to invest in stocks, and I don’t mean buying NVIDIA—you want to diversify.

Diversify

Diversification is the main purpose of building portfolios rather than investing in a single asset. The gold standard for achieving this is investing in ETFs and mutual funds, which are already baskets of other assets. That way, you can stay well-diversified while managing just a few different “tickers.”

For example, by investing in VT (Vanguard Total World Stock ETF), you invest in thousands of companies worldwide. You’re still exposed to market fluctuations, but not to the risk of a single company’s bankruptcy wiping out your investment. Equally important, you stay neutral sector-wise and gain exposure to both developed and emerging markets across the globe. There are many ETFs and mutual funds tracking specific niches, which is what you want to avoid. FIRE is not about making market bets but about achieving your desired lifestyle safely and surely. With VT, you don’t play the stock-picking game and instead invest in the entire global stock market.

Keep Fees Low

As we’ve picked VT as an example, it also fits the second most important criterion by having very low management fees. Thousands of assets offer different diversified baskets, but many hide high management fees. As a result, despite investing in appreciating assets, your long-term returns are cannibalized. The lower the fee, the better! With Vanguard ETFs and mutual funds, fees are almost negligible, averaging around 0.07%. This is what you’re looking for. Try ETF Expense Ratio Calculator and see how much fees affect your investment long term.

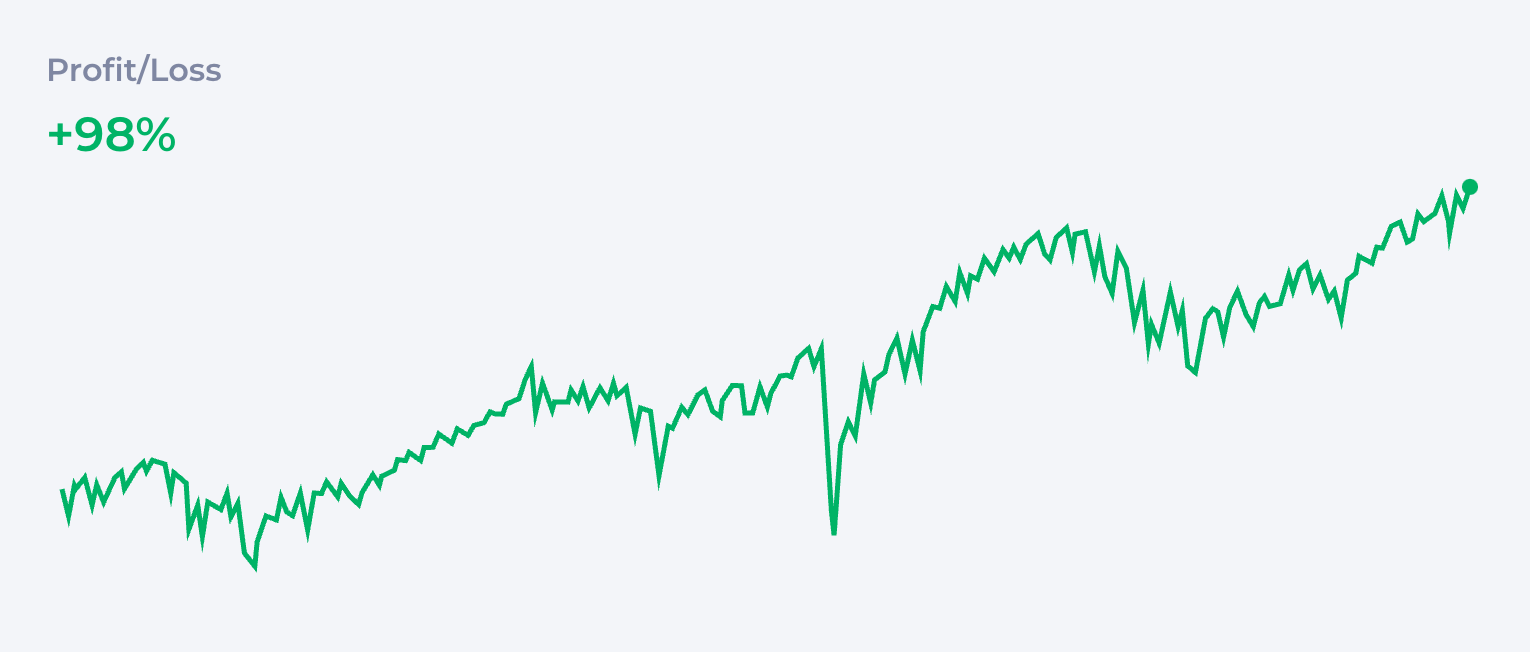

Investing only in one broad market ETF like VT creates a simple 100% stock portfolio that already puts you on the way to FIRE.

| Asset | % | |

|---|---|---|

| VT | Vanguard Total World Stock ETF | 100% |

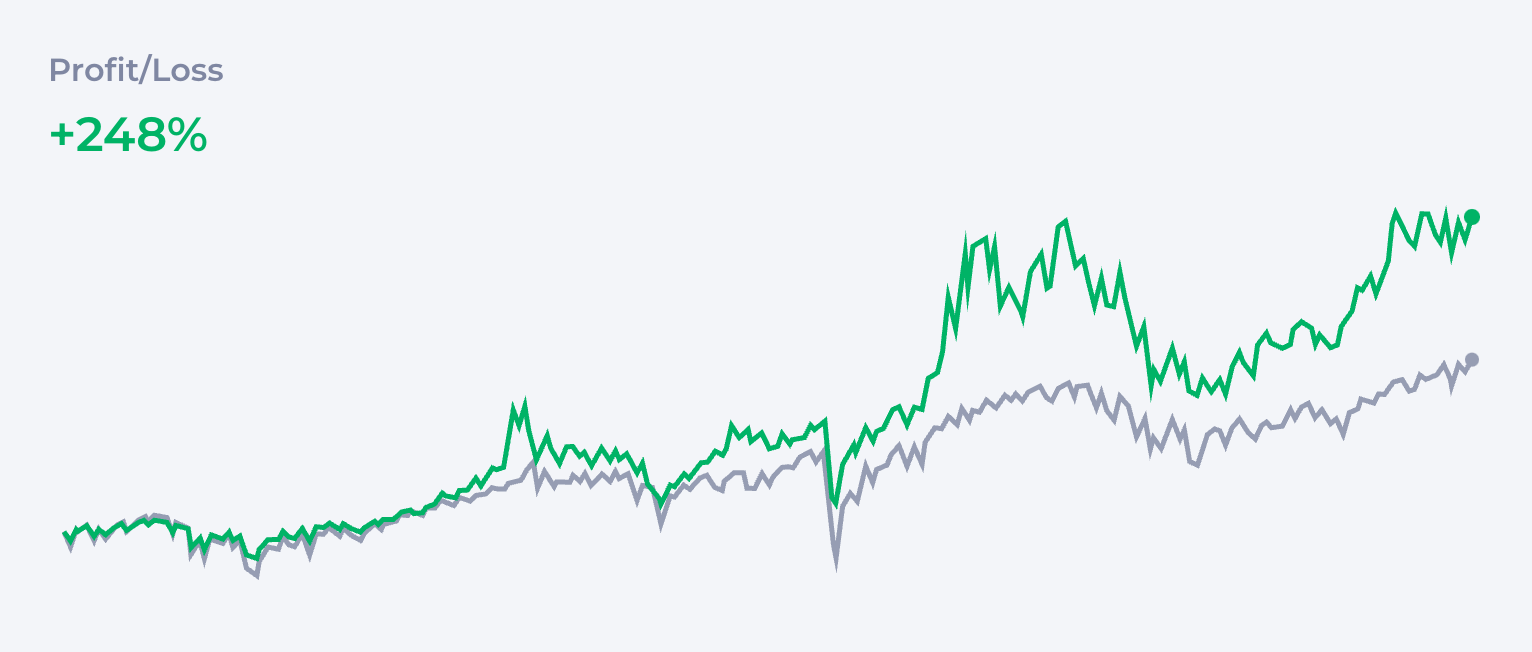

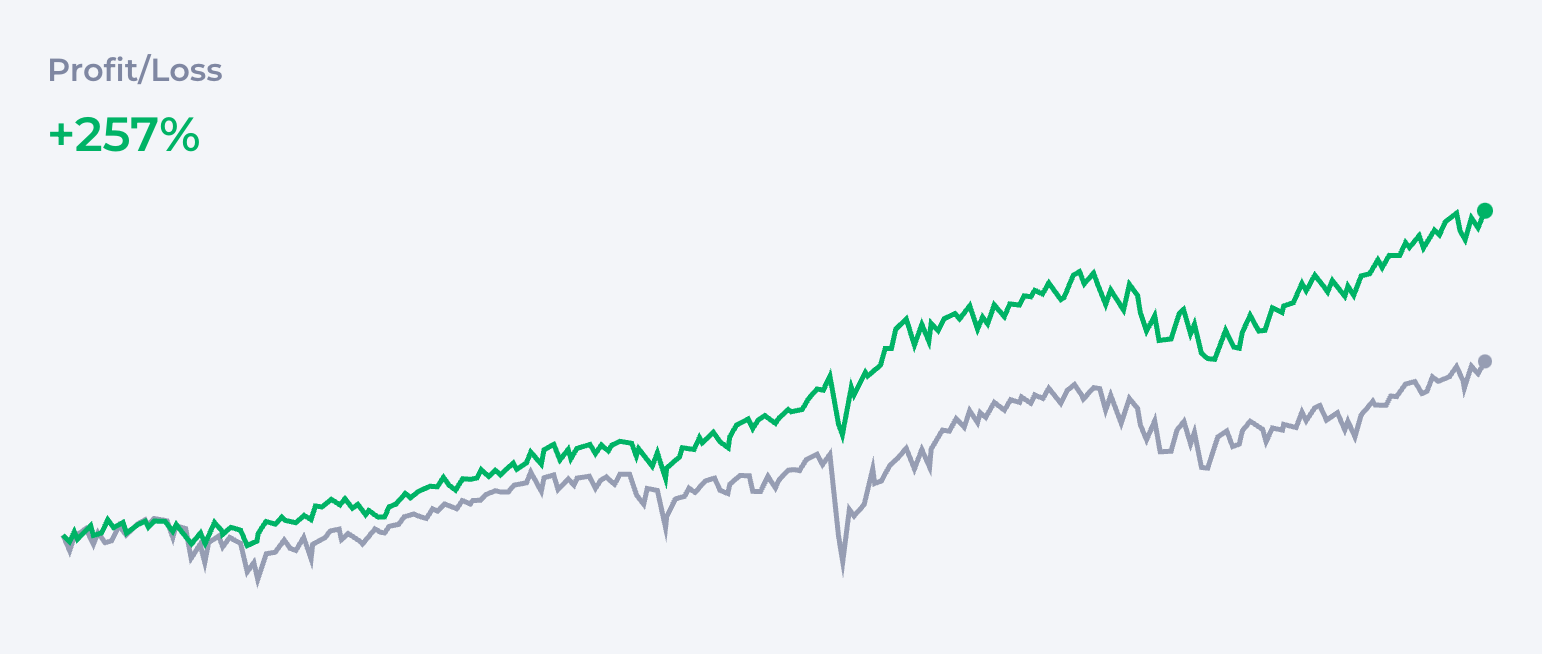

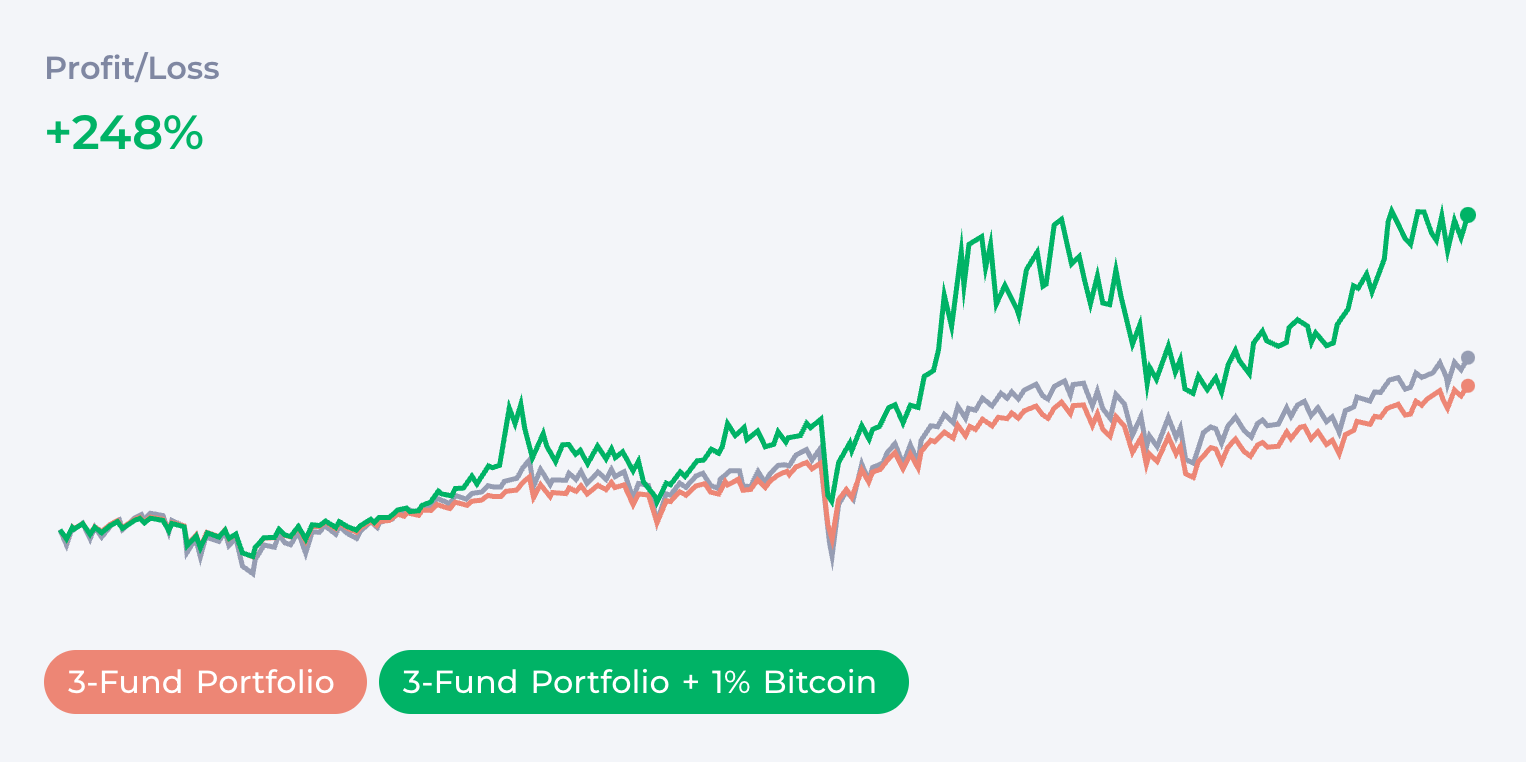

On the following charts we’ll use the global stock market as a benchmark, so the grey line is always Vanguard Total World Stock ETF. All backtests have been done with our Portfolio Analyzer1.

## Traditional Retirement Portfolios

Vanguard Three-Fund Portfolio

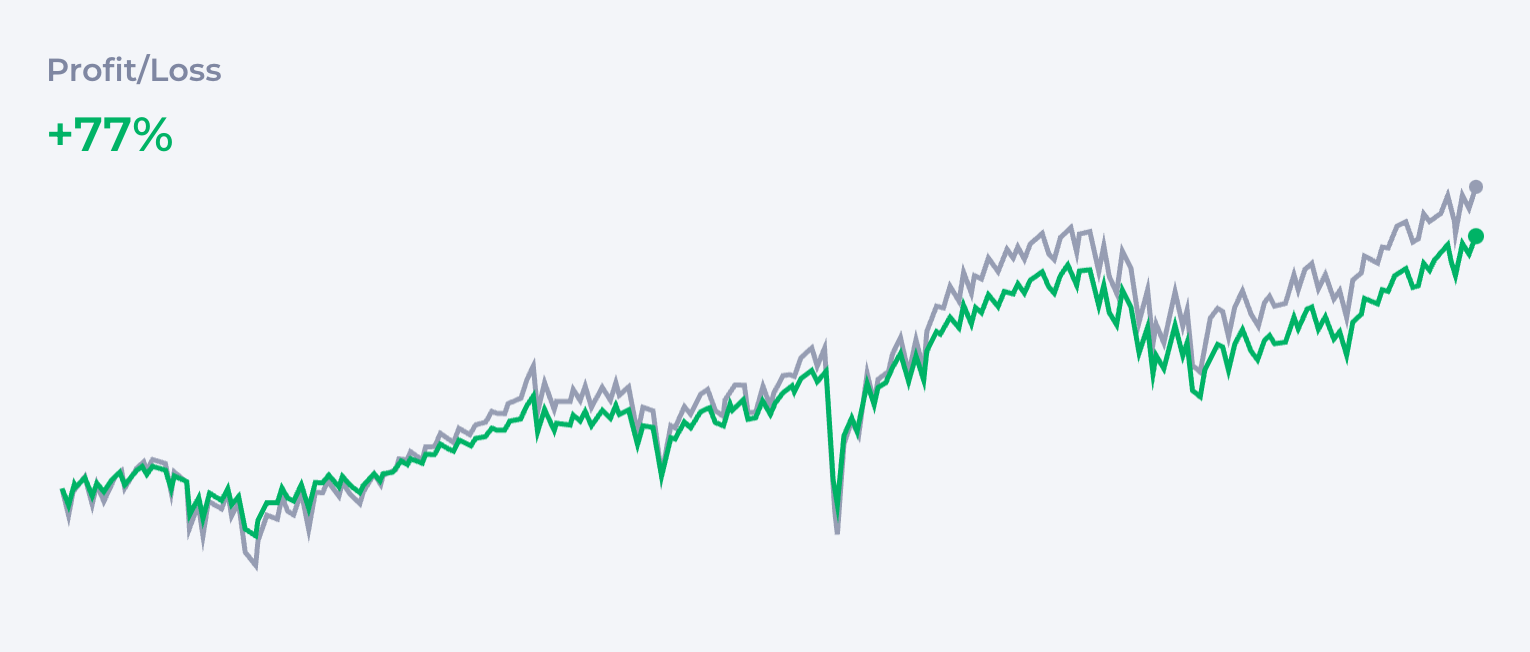

What most people consider the basic recommendation is the famouns lazy Three-Fund Portfolio, originally proposed by Taylor Larimore in his book. This portfolio includes three types of assets to ensure a balance of growth, diversification, and risk management: U.S. stocks, international stocks, and bonds. Since it’s very popular in the Bogleheads community2, usually contain low-cost Vanguard ETFs or mutual funds. Here is an example of the 3-fund portfolio allocation:

| Asset | % | |

|---|---|---|

| VTI | Vanguard Total Stock Market ETF | 40% |

| VXUS | Vanguard Total International Stock ETF | 30% |

| BND | Vanguard Total Bond Market ETF | 30% |

The beauty of the 3-fund strategy is its simplicity, yet it offers exposure to the entire global stock market and a safety net through bonds, all while keeping costs low.

The allocation in the table is more of an example since Larimore emphasized that there is no one-size-fits-all approach to a Three-Fund Portfolio. He advocates for adjusting the allocation based on factors like age, risk tolerance, and financial goals. For instance, younger investors with a long time horizon might lean more heavily into stocks (both U.S. and international) to maximize growth, while those nearing retirement may allocate a higher percentage to bonds for stability and income.

A popular variant of this idea can be the Four-Fund Portfolio created by adding REITs like VNQ (Vanguard Real Estate ETF). It provides exposure to real estate, which can add income and further diversify the portfolio.

| Asset | % | |

|---|---|---|

| VTI | Vanguard Total Stock Market ETF | 35% |

| VXUS | Vanguard Total International Stock ETF | 25% |

| BND | Vanguard Total Bond Market ETF | 25% |

| VNQ | Vanguard Real Estate ETF | 15% |

Dividend-Focused Portfolio

Some FIRE followers focus on dividend-paying stocks or dividend-focused ETFs to generate passive income before and during early retirement. Common ETF choices include:

| Asset | % | |

|---|---|---|

| VYM | Vanguard High Dividend Yield ETF | 50% |

| SCHD | Schwab U.S. Dividend Equity ETF | 30% |

| HDV | iShares Core High Dividend ETF | 20% |

This strategy helps create cash flow for living expenses without needing to sell assets as often. It appeals to many people as dividends provide income in a psychologically more comfortable way. The downside is that, despite sounding great on paper, historically dividend stocks don’t grow as fast as growth-oriented stocks or the broader market index.

Growth-Oriented Portfolio

A popular choice for those with an appetite to retire as soon as possible is focusing on high-growth sectors like technology or innovation, with QQQ being the most popular choice. It’s hard not to see why. QQQ follows the NASDAQ-100 index, which is composed of 100 of the largest non-financial companies listed on the NASDAQ stock exchange. These include some of the biggest names in tech like Apple and Alphabet (Google).

| Asset | % | |

|---|---|---|

| QQQ | Invesco QQQ Trust | 100% |

On the chart, QQQ consistently performs better than VOO, which performs better than VTI, which performs better than VT. Of course, that assumes that the market will behave similarly in the future, so it’s not as neutral as buying VT. However, there are also many reasons to expect QQQ will keep growing faster than the rest of the economy, particularly because it contains all the companies driving the AI revolution. From that perspective, you might do even better by selecting just those AI giants: Apple, Microsoft, Amazon, Alphabet, Tesla, NVIDIA, and Meta.

Or, focusing on individual tech giants:

| Company | % | |

|---|---|---|

| AAPL | Apple Inc. | 10% |

| MSFT | Microsoft Corporation | 10% |

| GOOG | Alphabet Inc. | 10% |

| INTC | Intel Corporation | 10% |

| GILD | Gilead Sciences Inc. | 10% |

| FB | 10% | |

| AMZN | Amazon.com, Inc. | 10% |

| CSCO | Cisco Systems Inc. | 10% |

| QCOM | Qualcomm Incorporated | 10% |

| GOOGL | Alphabet Inc. | 10% |

So, potentially bigger gains or diversification? That’s up to you to decide. By being more focused, you expose yourself to sector-specific risks; by being more neutral, you’re giving up some potential gains. Most investors pick something in the middle of this scale. We’ll get back to it when talking about risk.

Alternative Portfolios

Barbell Portfolio

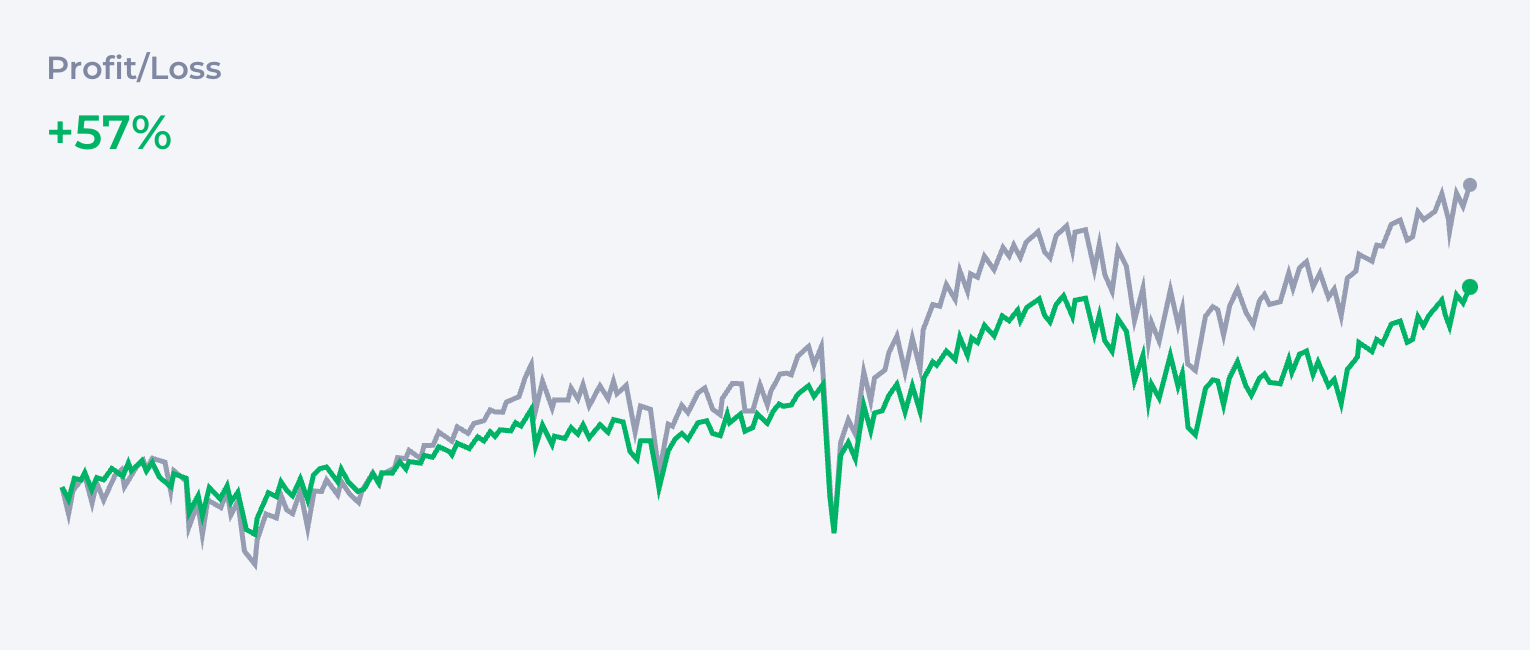

A slightly different goal can be achieved with the Barbell Strategy that combines higher-risk growth assets like QQQ with safety assets like bonds. Such a portfolio can provide similar gains to a broad market index but limit the maximum downside. Whether this strategy is better than investing in the broad market index depends on if the future performance of the growth assets you picked will also be greater than the broad index.

| Asset | % | |

|---|---|---|

| QQQ | Invesco QQQ Trust | 50% |

| BND | Vanguard Total Bond Market ETF | 50% |

All-Weather Portfolio

While most experts recommend simply investing in stocks, some FIRE enthusiasts may look for protection from different types of risk. By combining different classes of assets, you can create a portfolio that will perform better in scenarios where the stock market is down. The original All Weather Portfolio was proposed by Ray Dalio and contains 30% in stocks, 55% in fixed income, and 15% in commodities.

| Asset | % | |

|---|---|---|

| VTI | Vanguard Total Stock Market ETF | 30% |

| TLT | iShares 20+ Year Treasury Bond ETF | 40% |

| IEI | iShares 3-7 Year Treasury Bond ETF | 15% |

| GLD | SPDR Gold Shares | 7.5% |

| DBC | Invesco DB Commodity Index Tracking Fund | 7.5% |

Dalio’s portfolio is more defensive and trying to neutralize all potential problems. As you can see, it behaves well during crashes, but at the expense of very little growth.

FIRE + Crypto

NEW! Our deep dive into the Radical Portfolio Theory by Jeff Park is an absolute must-read for investors in digital assets.

Adding crypto to a retirement portfolio is still a controversial topic for many, but at Deltabadger we love Bitcoin, so here’s all you need to know:

There is no broad-market “crypto ETF” (as of now), but Bitcoin behaves like one, has ETFs in some markets, and is probably the only asset worth considering for this strategy. If you plan to rebalance your portfolio, an ETF is a better option; however, holding Bitcoin directly on your hardware wallet offers protection from some more “extreme” scenarios like bank account seizure.

Multiple Bitcoin cycles show a very high correlation with other cryptocurrencies, which makes it a questionable idea to diversify between different crypto assets, not to mention the total collapses of many of them. This picture may change in the future, especially when we see more crypto ETFs. However, it’s worth noting that projects like Solana are centralized and have some legal entity behind them, so betting on them may be associated with risks similar to stock-picking single companies.

Bitcoin is not risk-free. It’s a new asset that didn’t exist 20 years ago, and the future is unknown. It’s subject to unique threats like regulatory risk (although the ETF confirms its legal status in the financial framework). That said, it not only offers diversification as a new uncorrelated asset class and high cash-like liquidity but also remains the best-performing macro asset for over a decade.

| Asset | % | |

|---|---|---|

| VTI | Vanguard Total Stock Market ETF | 70% |

| VXUS | Vanguard Total International Stock ETF | 20% |

| BTC | Bitcoin | 10% |

Whether you choose ETFs or direct Bitcoin ownership, consistency matters more than timing. A crypto DCA bot can automate your Bitcoin accumulation strategy, ensuring you stick to your allocation targets regardless of market conditions.

Let’s Talk Risk

There are many options between just buying the VT ETF and going all-in on Bitcoin and trendy tech giants. Experts say the ideal portfolio depends on your risk tolerance, but what does that even mean? For many, the goal isn’t just a single retirement number but reaching milestones along the way. One of the most important is Coast FIRE: the point where you have enough invested that it will grow to cover a traditional retirement without any further contributions. Knowing this number, which you can find with a Coast FIRE calculator, can significantly change your approach to risk.

There is no perfectly neutral portfolio. Even buying just VT, you accept some allocation of assets that is not perfectly neutral and still gives more weight to the U.S. market. On the other hand, goldbugs and Bitcoin maximalists will point out various systemic risks that make relying on stocks and government bonds risky.

I would start in a different place.

How Long Can a Bear Market Last?

When we discuss long-term investing, you need a different perspective on market volatility. The longest bear market in history lasted three years, from 1946 to 1949. Taking the past 12 bear markets into consideration, the average length of a bear market is only about 14 months. It usually takes at least the same amount of time for the market to get back where it was, so looking at the most recent examples:

It took 6 years to fully recover from the DOTCOM crash, and almost 5 years to recover from the 2008 crisis. If you were an unlucky investor who held stocks from 2001 to 2011, your portfolio would have seen zero growth.

But that’s only half of the story because…

Dollar-Cost Averaging Changes Everything

When you contribute to your retirement account monthly from every paycheck, you’re effectively using Dollar-Cost Averaging (DCA), and the “crash” allows you to buy assets at better prices. Actually, by the end of those 10 years, you’d be significantly in profit. In fact, you would do better than holding bonds. Long-term investing in ETFs following market indices is not particularly risky. What people mean by “risk tolerance” is the psychological aspect of investing—how do you react to market fluctuations? That’s a valid question. However, when you look just at numbers, for a time frame of 10+ years, even more focused indices are sufficiently safe.

Bonds Are Not FIRE, but the Bucket Strategy Will Help Later

While bonds provide protection from short-term volatility, long-term they slow you down. While you still have years until retirement, put all your capital into more productive assets.

So, are bonds just a waste of time?

Not at all! As soon as you reach your “number” (or get close to it), short-term protection for your capital is very important. After retiring, switch to a bucket strategy:

- Short-term bucket: Cash or short-term bonds for living expenses in the next 1-2 years.

- Medium-term bucket: Bonds or balanced funds for expenses in 3-10 years.

- Long-term bucket: Stocks (VTI, VXUS, etc.) for growth over 10+ years.

For the short term, have cash reserves or treasury bills. Exclude them from your portfolio. They should depend on your expenses and provide a safety buffer for at least a few months ahead.

Sequence-of-Returns Risk

Particularly relevant to FIRE is the sequence-of-returns risk—the risk of retiring at the start of a downturn. One of the common strategies is to gradually migrate the portfolio from more aggressive to more defensive as you approach retirement. What does it mean?

Imagine that while retired, you plan to keep 20% of your capital in bonds. Ten years before your retirement deadline, you start adding 2% of bonds a year to the mix, gradually changing the risk profile.

Gold and Bitcoin

The popular opinion among stock investors is that gold is “not productive.” In times of prosperity, it’s easy to acquire that perspective and forget about this “boring ancient asset.”

Gold Is Shinier Than You Think

However, let’s look at the long term. If you compare the price of gold to the performance of VTI since the DOTCOM bubble, you’ll learn that it massively outperforms the market and basically just doubled the money compared to what you would earn investing in the index.

So, Why Do So Many People Ignore Gold?

There are times, like the period from 2011, where the market went up for a decade while gold was stagnating. But at the same time, whenever the market was crashing: DOTCOM, 2008, COVID… gold was protecting your portfolio big time.

I invite you not to be dogmatic about gold and just look at historical data. By adding gold to your portfolio, you can achieve better safety without giving up all the gains that bonds take. Gold shines especially in barbell strategies. When you combine QQQ and GLD, you seem to get the best of both worlds.

| Asset | % | |

|---|---|---|

| QQQ | Invesco QQQ Trust | 60% |

| GLD | SPDR Gold Shares | 40% |

Is Bitcoin the New Gold?

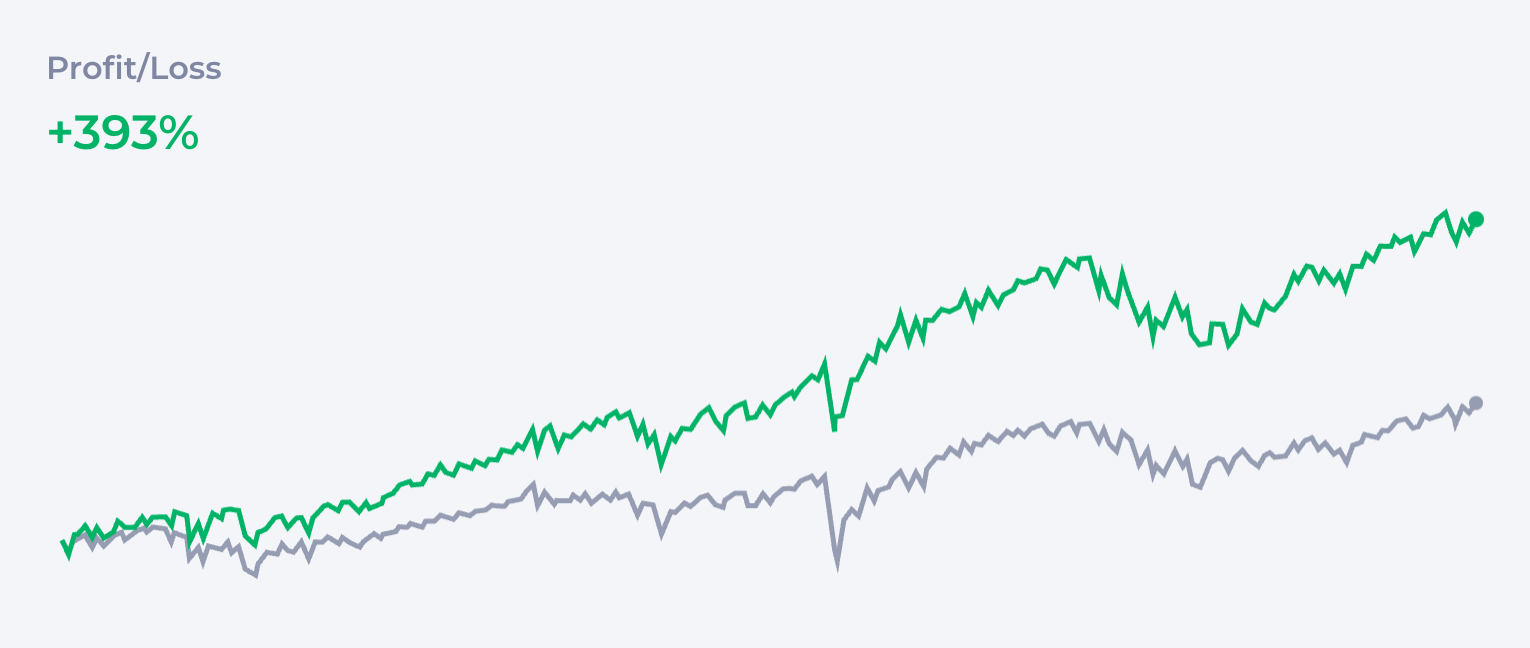

Then we have Bitcoin, which many consider “gold 2.0.” At Deltabadger, we love Bitcoin, and it’s part of our DNA.

That said, Bitcoin is a true wildcard. As the most volatile macro asset, it’s hard to treat it as protection from some market seasons. On the other hand, the growth of Bitcoin was so spectacular that even a little bit of it in the portfolio completely dominates the chart.

Do you remember the classic 3-fund portfolio from the beginning of this article? Adding only 1% of Bitcoin trippled the money with risk capped at 1%. I would say it’s the risk worth taking even by the most conservative investors.

| Asset | % | |

|---|---|---|

| VTI | Vanguard Total Stock Market ETF | 40% |

| VXUS | Vanguard Total International Stock ETF | 30% |

| BND | Vanguard Total Bond Market ETF | 29% |

| BTC | Bitcoin | 1% |

Like when discussing the risk of stocks, remember that the right way to build your position is dollar-cost averaging, which significantly decreases your risk exposure.

Hungry for more? Read the dedicated article presenting the case for our extreme version of the ‘FIRE portfolio’—not for the faint-hearted.

Portfolio Rebalancing

While the stock market is strongly correlated and often all indices move together, when you add different asset classes like gold and Bitcoin, you can experience moments of significant divergence, where one asset goes up and others go down or sideways.

That creates both the need and opportunity for rebalancing, which can additionally increase the stability of your portfolio. If you discover that Bitcoin, which is supposed to be 2% of your portfolio, is now 3% or 4%, sell the difference and put it back into other assets. That way, not only does your exposure to its volatility stay under control, but you also have an opportunity to collect some gains along the way.

Rebalancing is a big topic that deserves a separate article. Remember that if you plan to do rebalancing, it can expose you to capital gains tax. Look for solutions like Roth IRA that allow you to avoid it, and significantly improve the efficiency of rebalancing.

Conclusion

I’ve tried to briefly cover all the popular approaches to retirement portfolios, and hopefully, you’ve found something useful for yourself. In future articles, we’ll dive deeper into the nuances of many topics touched on here.

Does this feel overwhelming? Building a portfolio can be a lifelong journey. Start simple: open your brokerage account and begin dollar-cost averaging into VOO. You’re already on the right path.

Footnotes

FAQ

What is the 4% rule for FIRE? +

The 4% rule is a guide that says you can withdraw 4% of your savings every year in retirement, and your money should last forever (or at least 30 years). That's where the '25 rule' comes from (25 x 4% = 100%).

How can I retire at 35? +

To retire at 35, you need to save a lot—like 50-70% of what you earn—and invest aggressively into stocks. Bitcoin can help too, but avoid speculating on small crypto and single stocks. 'Surely' is better than 'fast… maybe'.

Is 60/40 portfolio good for FIRE? +

The 60/40 portfolio splits your money: 60% in stocks to grow your wealth and 40% in bonds to keep things safe. It’s been a popular conservative strategy. Is it a good strategy for FIRE? No. Start buying bonds when you already reached your retirement portfolio goal.

What is the 110 age rule? +

The 110 age rule helps you figure out how much to invest in stocks based on your age. Just subtract your age from 110. If you’re 30, you’d invest 80% in stocks and the rest in bonds. It’s a simple way to adjust as you get older. Good for FIRE? Definitely not. Leave it to your grandparents.

What is the 60/20/20 rule for portfolios? +

This splits your investments into 60% stocks for growth, 20% bonds for safety, and 20% into other things like real estate or gold for variety. It’s all about spreading your money around. A classic 3-Fund portfolio. Read about pros and cons above.

What should a balanced portfolio look like? +

A balanced portfolio mixes uncorrelated assets: stocks, bonds, gold, bitcoin, real estate… you got the idea. Putting together a bunch of altcoins or stocks is not 'balanced' or 'diversified.'

What is the 7-year rule for investing? +

The 7-year rule says that if you leave your money in the stock market long enough, it tends to double about every 7 years (based on an average 10% annual return).

—

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investing involves risks, including the possible loss of principal. Always conduct your own research before making investment decisions.