FIRE Dividend Portfolio

A Sober Look at Dividend Investing for Early Retirement

If you search for “dividend investing” online, you’ll find countless videos and articles promising quick paths to early retirement through dividend income alone. They showcase impressive monthly earnings and seemingly endless passive income streams flowing into brokerage accounts.

But here’s the sobering truth: relying solely on dividends for financial independence is an extremely risky proposition. Let me explain why, and more importantly, show you how to build a realistic FIRE portfolio that uses dividend investing as one of its core strategies.

The Reality of Living Off Dividends

Let’s look at a concrete example. The SPYD ETF, which tracks high-dividend stocks within the S&P 500, paid $1.86 per share in dividends last year. If you wanted to generate $15,000 annually (roughly $5,000 monthly) from dividends alone, you would need to own approximately 8,000 units of this fund. At current prices, that’s an investment of about $344,000 - and that’s before considering taxes!

This simple calculation reveals an important truth: to generate meaningful income from dividends alone, you need substantial capital first. The idea of quickly achieving financial independence through dividends alone is not a a realistic strategy.

To understand your numbers better, check our 6 calculators for long-term investors.

Total Return: The Complete Picture

So what should motivate us to invest in dividend-paying stocks? The answer lies in the total return - the combination of dividend payments and capital appreciation from stock price increases. This is crucial to understand: your actual earnings from stock investments come from both price changes and dividends, and we can’t afford to neglect either component.

Looking at historical data from the S&P 500, dividends have played a varying but significant role in total returns over time. In the 1970s, they contributed as much as 70% of total returns, and during challenging periods like the 1930s and 2000-2009, dividends were sometimes investors’ only source of positive returns.

While dividends have averaged about 40% of total returns from the 1930s to present day, their contribution has decreased significantly since the 1990s - dropping to just 16% in 2010-2020 and falling further to only 8% in the post-COVID era.

Why the Shift?

This dramatic change in dividend contribution can be attributed to several factors:

-

Post-2008 Monetary Policy: Quantitative easing and near-zero interest rates globally created an environment where non-dividend-paying growth companies could thrive.

-

Tech Dominance: Technology companies now represent over 33% of the S&P 500’s capitalization. These companies often prioritize growth over dividend payments.

-

Market Concentration: Nearly 40% of the main index’s capitalization comes from just 10 companies, with only three (Apple, Microsoft, and Broadcom) being considered dividend stocks.

The Power of Dividend Growth

Despite these changes, don’t underestimate the long-term impact of dividends. When comparing the S&P 500 price index (excluding dividends) to the S&P 500 Total Return (including reinvested dividends), the difference is striking:

- Dividends improve the average annual return by 4 percentage points (from 7% to 11%)

- Over many years, this creates an enormous difference due to compound interest

This “dividend snowball” effect is particularly powerful because it works on two levels: not only do your reinvested dividends buy more shares, but those companies often increase their dividend payments over time. A company paying $1 per share today might pay $2 in five years, meaning each reinvested share generates twice the dividends going forward. This double compounding—more shares earning higher dividends per share—can create exponential growth over decades.

This effect is even more pronounced in some markets. For example, Poland’s WIG20 index:

- With reinvested dividends: +146% (since 2005)

- Without dividends: +17%

- During a period when inflation was 90%

Smart Dividend Investing: The FIRE Approach

Here’s where many investors go wrong: focusing solely on dividend yield. A high dividend yield isn’t necessarily better - in fact, it might indicate problems. Here’s why:

Dividend yield is simply the annual dividend divided by the current stock price. If a stock pays $5 per share annually and trades at $100, that’s a 5% yield. But since stock prices change daily while dividends typically change slowly, the yield mainly reflects price movements, not dividend quality.

A rising yield often comes from a falling stock price - not an ideal situation. For example, when Federal Realty Trust’s stock price fell 30%, its yield increased from 3.5% to 4.7%. The higher yield couldn’t compensate for the capital loss.

Understanding Dividend Sustainability Risks

Today’s dividend is not guaranteed tomorrow. The 2020 pandemic provided a stark reminder of this reality when Disney, after 57 years of consistent dividend payments, suddenly suspended its dividend to preserve cash. Even Royal Dutch Shell, which hadn’t cut its dividend since World War II, slashed its payout by 66%.

But these dramatic cuts don’t happen without warning. Take AT&T’s story: for years, it was a favorite among dividend investors, offering an attractive yield above 6%. However, beneath the surface, warning signs were mounting. The company’s payout ratio had climbed above 100%, meaning it was paying more in dividends than it earned. Free cash flow was deteriorating, and debt levels were rising. By 2022, the inevitable happened – AT&T cut its dividend by nearly 50%.

The story often follows a similar pattern. First comes the industry stress – think of energy companies during the 2014-2015 oil price collapse. Then management’s tone shifts during earnings calls, suddenly emphasizing “capital flexibility” instead of their usual confident stance on dividends. Finally, the credit rating agencies step in with downgrades, and the dividend cut follows shortly after.

State-owned companies present a unique risk. While they often appear to be stable dividend payers, their payouts can change dramatically with shifting political winds or policy priorities. What seems like a reliable income stream can vanish with a single shareholder meeting decision.

The key to avoiding these dividend traps? Watch for deteriorating fundamentals, especially the payout ratio (anything above 80% is a red flag), and maintain diversification. Remember: even the most reliable dividend payer can face circumstances that force a cut.

The Better Approach: Dividend Growth Investing

Instead of chasing high yields, focus on dividend growth investing - companies that consistently increase their dividends year after year. Let’s take PepsiCo as an example:

- Increasing dividends since 1973 (53+ years)

- Last 20 years:

- Stock price: +380%

- Dividend growth: +890%

- Current yield: 3.6%

- Average annual dividend growth: 7%

- Payout ratio: ~65%

Companies that consistently increase dividends tend to be well-managed, free from excessive debt, generate growing profits, and maintain sustainable payout ratios.

Finding Dividend Growth Stocks

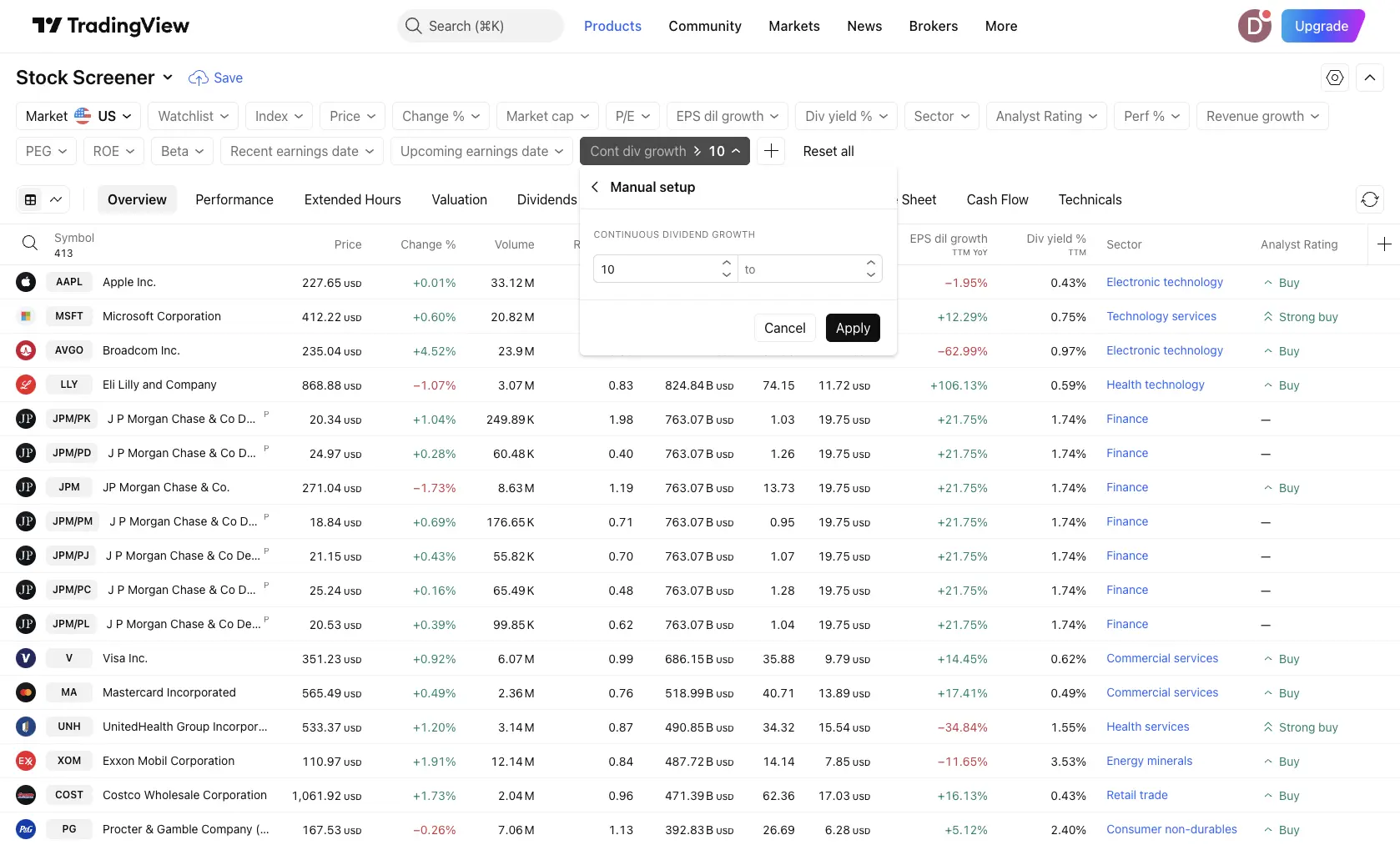

While ETFs offer a convenient way to invest in dividend growth stocks, some investors prefer selecting individual companies. Here’s how to screen for potential candidates using TradingView’s stock screener:

- Go to TradingView’s Stock Screener

- Add these essential filters:

- Dividend Yield > 2% (adjustable based on your goals)

- Dividend Growth Rate > 5% (past 5 years)

- Payout Ratio < 75%

- Market Cap > $10B (for stability)

- Additional quality filters:

- Debt/Equity < 1.5

- Return on Equity > 15%

- Positive Free Cash Flow Growth

This screening process helps identify companies with sustainable dividend growth potential. Remember to research each company thoroughly beyond these metrics, paying special attention to their competitive advantages and industry position.

Dividend Aristocrats: The Elite League

The most reliable dividend payers belong to an elite group called Dividend Aristocrats - S&P 500 companies that have increased their dividends for at least 25 consecutive years. Currently, only 59 out of 500 companies qualify.

Why focus on Aristocrats?

-

Defensive Characteristics: During market downturns, they typically fall less than the broader market:

- 2022 Bear Market:

- NASDAQ: -30%

- ARK Innovation ETF: -70%

- Dividend Aristocrats: -15%

- 2022 Bear Market:

-

Sector Diversification: Less exposure to volatile tech sectors, more weight in defensive industries

-

Strong Hands: Typically owned by long-term investors who don’t panic sell

-

Historical Performance: Over long periods, Dividend Aristocrats have outperformed the S&P 500, especially during market downturns

Building Your FIRE Dividend Portfolio

For those interested in dividend growth investing as part of their FIRE strategy, here are practical steps:

-

Choose Quality Over Yield:

- Focus on companies with 10+ years of dividend growth

- Look for dividend growth rates above inflation (>3%)

- Consider Dividend Aristocrats for stability

-

Consider ETFs:

- SCHD: Focuses on 10+ years dividend growth stocks

- NOBL: Tracks Dividend Aristocrats

- SCHY: International dividend growth stocks (ex-US)

-

Geographic Diversification:

- While US dominates dividend growth stocks, consider some international exposure

- Be aware that quality dividend growers are harder to find outside the US

Track your portfolio’s performance using our Portfolio Analyzer to ensure you’re meeting your FIRE goals.

Current Market Context and Why US Stocks

You might wonder why we focus on US stocks when their valuations are currently among the highest globally. The forward P/E ratio for the S&P 500 is at levels similar to those seen before the 2021 correction and not far from the 2000 dot-com bubble. Most valuation metrics (P/E, P/B, P/CF) are significantly above their 30-year averages.

However, there’s a compelling reason for this US focus: quality dividend growth stocks are predominantly found there. When searching for companies that have consistently increased dividends for at least 10 years while outperforming the S&P 500, US stocks dominate the list. For companies with 25+ years of dividend growth, the US becomes practically the only market available.

While Europe offers some options (including three notable Polish companies: Dom Development, NOA, and Asso Business Solutions), the selection is limited compared to the US market.

Tax Implications for International Investors

It’s important to note that US dividends are subject to a 15% withholding tax for international investors. This affects your real returns and should be factored into your calculations. For example, a 4% dividend yield effectively becomes 3.4% after the withholding tax.

ETF Selection and Strategy

When it comes to dividend ETFs, investors have several excellent options depending on their specific goals and geographical location:

US-Listed ETFs

-

SCHD (Schwab US Dividend Equity ETF):

- Best overall choice for dividend growth

- Focuses on companies with 10+ years of dividend growth

- Low expense ratio (0.06%)

- Strong track record of both dividend growth and capital appreciation

-

NOBL (ProShares S&P 500 Dividend Aristocrats ETF):

- Most conservative approach focusing on Dividend Aristocrats

- Excellent defensive characteristics during market downturns

- Higher expense ratio (0.35%) but unique exposure to elite dividend growers

-

VYM (Vanguard High Dividend Yield ETF):

- Higher current yield focus (3%+)

- Lower expense ratio (0.06%)

- More suitable for income-focused investors

- Less emphasis on dividend growth compared to SCHD

-

DGRO (iShares Core Dividend Growth ETF):

- Balance between current yield and growth

- Low expense ratio (0.08%)

- Requires only 5 years of dividend growth (vs. 10 for SCHD)

- Good option for younger companies with strong growth potential

UCITS ETFs for International Investors

For investors outside the US who need UCITS-compliant funds:

-

VHYL (Vanguard FTSE All-World High Dividend Yield UCITS ETF):

- Global exposure to high-yield stocks

- Available on European exchanges

- Good alternative to VYM

- Trades in multiple currencies

-

UDVD (UBS ETF Dividend Aristocrats ESG UCITS ETF):

- European equivalent to NOBL

- Includes ESG screening

- Available in EUR and GBP

-

IAPD (iShares US Dividend IQ UCITS ETF):

- US dividend focus

- Quality screening methodology

- Available on major European exchanges

While UCITS ETFs typically have higher expense ratios and may underperform their US counterparts, they offer necessary regulatory compliance for international investors. Consider your local tax implications and currency exposure when selecting between US-listed and UCITS options.

The Psychological Edge of Dividend Investing

One often overlooked advantage of dividend growth investing is its psychological benefits:

-

Reduced Trading Activity: Regular dividend payments help investors focus on income rather than price movements, leading to less frequent trading.

-

Better Long-term Results: Studies show the average investor achieves only about 3% annual returns due to emotional trading, while dividend growth strategies typically deliver 9-12% annually.

-

Peace of Mind: Knowing you own companies with 25+ years of dividend growth through major market crashes (2000, 2008) provides confidence during market turbulence.

-

Focus on What Matters: Monthly or quarterly dividends allow you to concentrate on family, work, or business rather than daily stock prices.

Practical Considerations for Dividend Investing

Before diving into dividend investing, it’s crucial to ensure you have the proper foundation in place. Start by carefully selecting a broker that offers comprehensive access to US-listed stocks and ETFs, along with robust international trading capabilities at reasonable fees. Your chosen platform should support dividend reinvestment programs (DRIPs) and have a solid track record handling foreign tax documentation. Market access is another key consideration - while US markets offer the highest quality dividend growth stocks, many international brokers have limited access to US securities and may not offer all the dividend ETFs you’re interested in. Factor in currency conversion costs and foreign exchange fees when evaluating platforms.

Tax efficiency should also be top of mind as you establish your dividend investing framework. Take time to understand how your local jurisdiction treats foreign dividends, explore tax-advantaged account options where available, maintain thorough records for foreign tax credit claims, and familiarize yourself with withholding tax implications. Getting these foundational elements right will set you up for long-term success with your dividend investing strategy.

Conclusion

Dividend investing can be a powerful tool, but it shouldn’t be your only strategy. The most successful approach combines:

- Focus on dividend growth rather than high yields

- Reinvestment of dividends during accumulation phase

- Understanding that total return (dividends + price appreciation) matters most

At Deltabadger, we believe that the optimal long-term portfolio combines different asset classes, with dollar-cost averaging into crypto playing an important part since, as a new asset class, crypto still offers the highest gains and will continue to do so for many years to come. That being said, while dividends alone might not get you to FIRE quickly, a well-constructed dividend growth portfolio can be one of the most reliable paths to financial independence.

—

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investing involves risks, including the possible loss of principal. Always conduct your own research before making investment decisions.